Latest Public Relations

Budget 2024 Expectations Highlights: Will FM Nirmala Sitharaman bring cheer to the common man?

The potential impact of supporting startups on job creation and social progress. He advocates for simplifying regulations, increasing capital diversity, and fostering innovation for economic growth.

Budget 2024 Expectations Highlights: Will FM Nirmala Sitharaman bring cheer to the common man?

The potential impact of supporting startups on job creation and social progress. He advocates for simplifying regulations, increasing capital diversity, and fostering innovation for economic growth.

Serial Investor Gaurav Singhvi Joins The Lion's Den Show, Aims to Democratise Entrepreneurship

As he steps into The Lion’s Den Show, donning his role as an investor, or Lion, Mr. Gaurav Singhvi carries with him not just his expertise, but the hopes and aspirations of countless entrepreneurs from every corner of India.

Budget Reactions from Industry Experts

We’re thrilled that the Union Budget 2024-25 has abolished the angel tax, as it will significantly boost investments in DPIIT-registered startups. This pivotal decision eases financial burdens and fosters startup growth, aligning with Avinya Ventures’ mission to support visionary entrepreneurs. The ₹1000 crore allocation for space startups also underscores the emphasis on high-tech sectors.

Budget 2024 Expectations Highlights: Will FM Nirmala Sitharaman bring cheer to the common man?

The potential impact of supporting startups on job creation and social progress. He advocates for simplifying regulations, increasing capital diversity, and fostering innovation for economic growth.

Will India emerge as a global economic powerhouse in 2024?

Against a backdrop of global economic volatility, coupled with food and oil supply shocks keeping inflation elevated, some may wonder whether India’s growth momentum will continue in 2024.

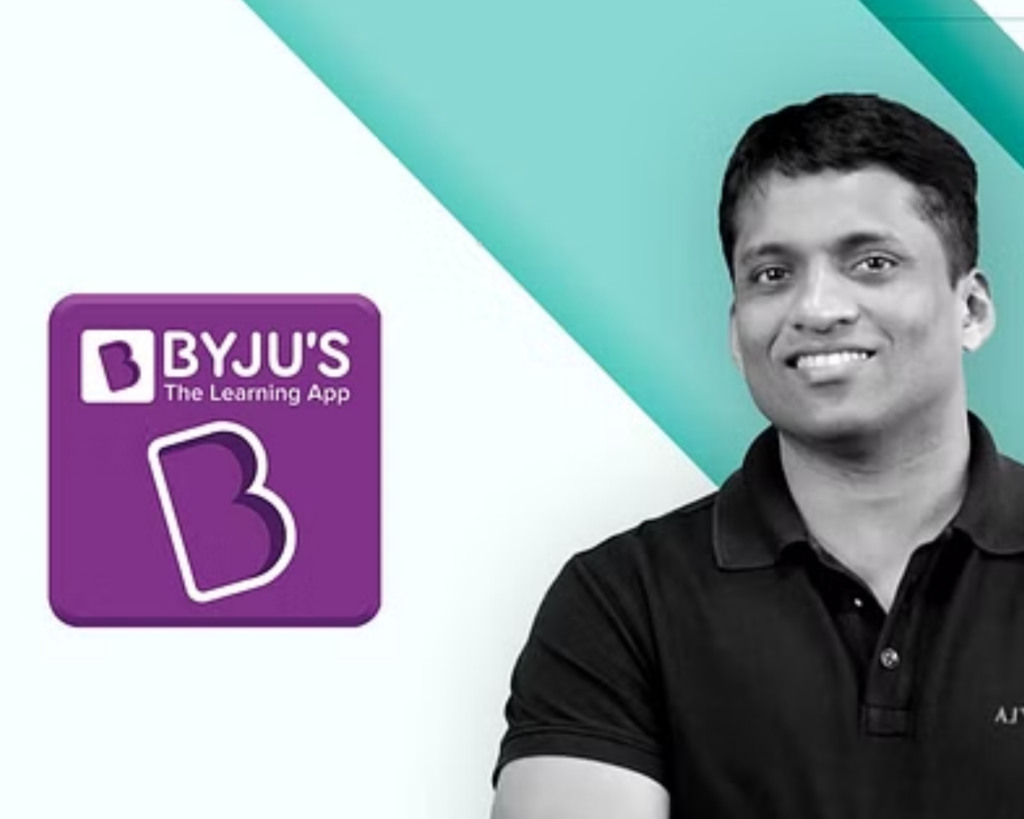

Byju’s year of challenges: will 2024 be any different?

The year 2023 has not turned up well for Indian start-ups – none more so than Byju’s, the marquee name in the Indian start-up and Unicorn space. The edtech company, which was not so long ago seen as a testament to the success of India’s start-up ecosystem, has seen it all during the year –investigation for FEMA violation, large-scale layoffs, defaults and mass exodus at the top.

We Founder Circle’s GIFT City Fund Raises $10 Mn, Onboards 250+ Investors

Angel investment networking platform We Founder Circle’s (WFC) GIFT City Fund has raised $10 Mn (around INR 83 Cr) and onboarded more than 250 investors. The GIFT City Fund, called WFC Global Angels Fund, has a target corpus of $30 Mn, with a green shoe option of $30 Mn.

Exploring the multifaceted partnership between India and the United States

India and the United States have recently agreed to work together more closely to support new ideas and businesses. The idea is to help startups handle challenges, share useful information, and improve the way entrepreneurs raise money.

Hype apart, India's Deep Tech Ecosystem struggles to attract Investment and Talent

While India’s deep tech sector is seeing a gradual upswing, several challenges persist, especially when it comes to sourcing patient capital and attracting the talent

Funding winter for Indian startups likely to end by March

Global investors are sitting on funds and once the “uncertainty” with regard to geopolitics, especially the Ukraine war and the Middle East crisis, gets over, the “funds would start flowing.

How to invest in Startups

In this exciting episode of “Dhan ki Baat,” we’re delving into the world of startup investments with a seasoned expert, G aurav Sanghvi. If you’ve ever dreamed of backing the next big thing or wondered how to navigate the exciting but risky world of startup investments, this episode is a must-listen.

Interview with CA Gaurav VK Singhvi, Startup coach & Co-Founder of We Founder Circle

At We Founder Circle, our approach as an active investor goes beyond providing financial support to the startups we invest in. We act as venture builders, working closely with founders to catalyze their growth in multiple ways.

How angel investing is emerging as an attractive asset class in India

Startups that get help from angel investors are four times more likely to succeed compared to those without their support. So, if you’re a startup, getting an angel investor can be a game-changer,

Hype apart, India's Deep tech ecosystem struggles to attract Investment and Talent

Investing in deep tech in India is not as common as investing in other types of technology. These projects take a long time to develop and show a profit, which makes them different from other tech businesses. In the beginning, they don’t make much money, but once they get going, they often grow rapidly.

The story of We Founder Circle, which provides Funding to more than 120 Startups

We Founder Circle (WFC), an early-stage startup investment platform, has funded over 120 startups so far. In the year 2022, it completed 71 funding rounds and invested in 53 startups. The company launched two angel funds in December 2022.

Why Funding for Startups will remain low till the year end?

The last quarter particularly faced significant challenges in funding. Looking ahead, the next two to three months are expected to continue at a similar pace. However, a turning point is anticipated around December and January, indicating a positive shift.

Fintech and Banking Sector To Attract Significant Attention

I took my first step as an investor in 2016. I invested in a company called dsyh (don’t scratch your head). This company was unique because it was solving a problem for ecommerce merchants

Foreign investments in start-ups come under ‘angel tax’ net

The availability of multiple valuation methods simplifies the process and removes some of the previous constraints,

The Story of We Founder Circle which provides funding to more than 120 startups

We Founder Circle (WFC), an early-stage startup investment platform, has funded over 120 startups so far. In the year 2022, it completed 71 funding rounds and invested in 53 startups. The company launched two angel funds in December 2022.

Why funding for startups will remain low till the year end?

The last quarter particularly faced significant challenges in funding. Looking ahead, the next two to three months are expected to continue at a similar pace. However, a turning point is anticipated around December and January, indicating a positive shift.

Income Tax Department Notifies 'Angel Tax' Rules For Startup Valuations

It provides relief to startups and investors by reducing the tax burden and simplifying the taxation of such investments. This significant change in policy provides much-needed relief by reducing the tax burden on both startups and investors.

G20 Summit: Startups hope Delhi Declaration to help ease capital access

A globally agreed-upon definition of startups will provide clarity and consistency in identifying and categorising startups. This will help Indian startups gain international recognition and potentially attract more global investment

Investing Communities Thriving in Tier 2/3/4 Cities: We Founder Circle taps investors in smaller towns

We are a community of 10,000-plus investors today. I have travelled to 43 cities in India this year meeting the investor community from small towns and cities, educating people about this asset class — startups.

Will BYJU's overcome spate of challenges coming its way?

Board resignations, combined with Deloitte’s departure as the company’s auditor, raise questions about internal governance, decision-making processes, and potential conflicts within BYJU’s. The absence of board members and an auditing firm may impact transparency, accountability, and overall corporate governance,” Gaurav V.K. Singhvi,

Optimising Decision-Making: AI's role in evaluating Start-ups for Investment

AI-powered research can streamline the investor community’s analysis of earnings transcripts and pitch decks, extracting key points into clear and concise briefings

Global VC funding slump: Assessing the impact of investor caution and interest rate hikes

Venture capital (VC) funding, which plays a crucial role in fueling innovation and supporting startups, has experienced a significant slump in recent times. The combination of investor caution and interest rate hikes has contributed to this decline, raising concerns about the future of VC investment and its impact on the entrepreneurial ecosystem.

Byju's Troubles Have Made Edtech A 'Stigmatised' Word

Now, increased scrutiny of Byju’s by regulatory authorities can instill uncertainty and caution among stakeholders, potentially influencing the overall sentiment and investment climate, said Gaurav VK Singhvi, an angel investor and co-founder at We Founder Circle.

Are BNPL start-ups in the Doldrums Because of their Client Profile?

“In this scenario, investors are not afraid to invest in BNPL companies,” he affirmed. However, he conceded that the sector could grow if it eliminates current challenges.

Can ONDC upset Swiggy/Zomato duopoly to disrupt the food delivery market?

Although ONDC’s hyperlocal tilt gives small sellers effective inroads in e-commerce, disruption in food delivery market will be contingent on building scale, meeting quality set up by Swiggy, Zomato

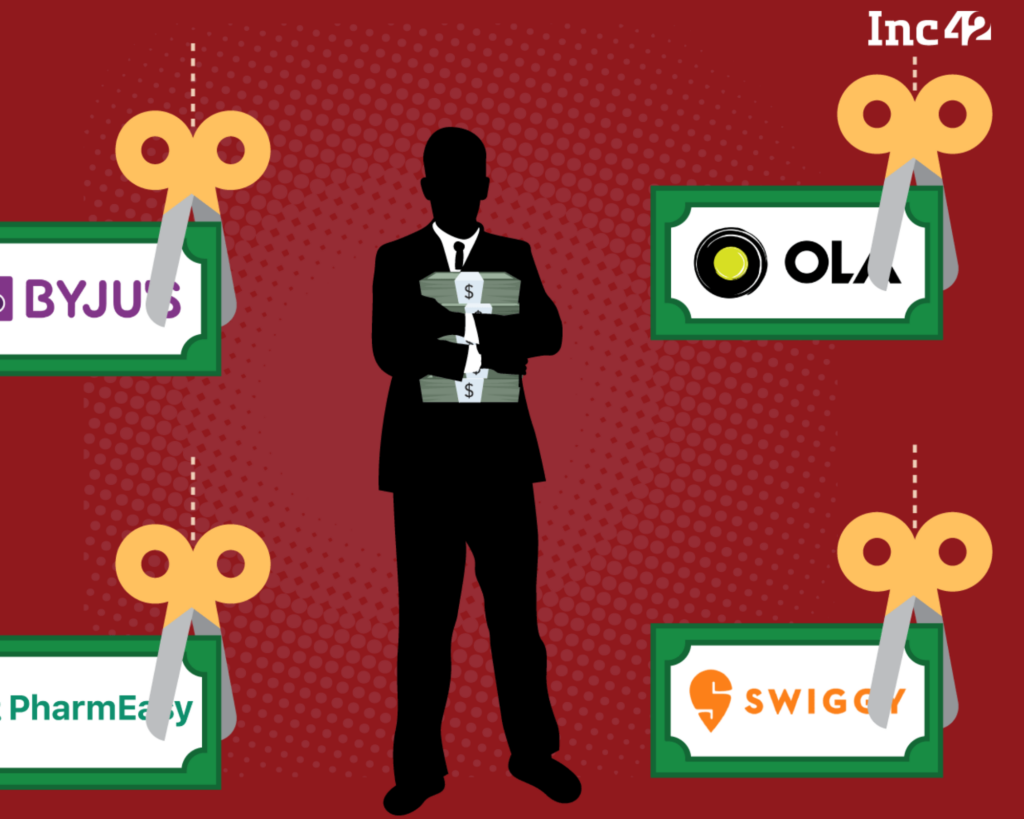

Valuation Cuts Calls for Prioritising a Sustainable and Resilient Startup Ecosystem

Gaurav VK Singhvi, Co-founder of We Founder Circle, added to this by pointing out that the valuation cuts present opportunities for investors to re-evaluate and potentially capitalise on the long-term potential of these promising startups.

Investors deliver reality check as Indian Startups sees Valuation Markdowns

Atleast five global investors have slashed the valuation of their stakes in India’s biggest tech majors in a matter of just two months

Valuation Markdowns Plague Indian Unicorns

An angel investor and the cofounder of investment firm WeFounderCircle Gaurav VK Singhvi attributes the markdowns to larger uncertainty in the markets. He told Inc42 that the downgrades were largely the result of a negative market environment turning out to be a stronger force than startups’ investor pull.

Strategies for Startups to Overcome the Funding Winter

As explained by Gaurav VK Singhvi, Co-founder of We Founder Circle, startups must be resilient, adaptable, and savvy in order to survive a funding shortage. Startups can overcome obstacles, establish sustainable growth, and create scalable enterprises around the world by utilising these tactics and keeping a long-term vision.

Bad loans, Defaults and a Failed Merger: How Zestmoney’s Rise hit a Roadblock

According to Gaurav VK Singhvi, co-founder of We Founder Circle, the BNPL firm faced a higher-than-usual credit default rate. He says that ZestMoney faced an inherently difficult loan recovery process where it had to allocate resources to address high service deficiency charges.

The Promise of Startup Pivot

They fear the potential risks associated with making significant changes to their business model. They might be concerned about losing their existing customer base, market position, or investment,” said Gaurav VK Singhvi, co-founder, We Founder Circle.

Is Paytm's Vijay Shekhar Sharma on the Verge of Silencing his Critics?

The digital payments unicorn has its work cut out if it wants to convince investors that it is on a sustainable profitability track, which warrants its valuation